Essential for Digital Nomads, Expats, and Frequent Travelers

Background location tracking

Nationly runs in the background and tracks your location

Ease Form 2555 Filing

We’ve made it easy to file Form 2555 for FEIE with your location data pre-filled

Import and capture location from Camera Roll

Easily fill in past location data by importing locations from your camera roll

Retain data for Global Entry renewal

All the trip info you need at your fingertips to renew your Global Entry

Track your countries on the go

Add our dynamic widget to your home screen to easily track your location

Ensure visa compliance

Keep track of how many days you have left with our handy location summary

Simplifying tax compliance for overseas Americans

Nationly is a mobile app for iOS that helps Americans abroad simplify qualifying for major tax savings under the Foreign Earned Income Exclusions by securely tracking your physical presence in the background. We automatically provide accurate, easy-to-use documentation for qualifying for the Physical Presence Test including export of Form 2555 pre-filled with your location data.

Visualize your location in a timeline

See where you’ve visited in an easy-to-navigate timeline filterable by year.

Add our widget to your home screen to see your location on the go

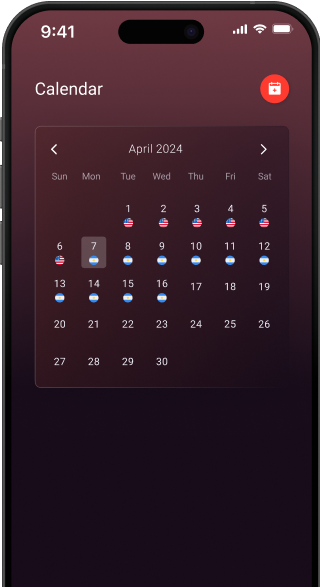

Browse your calendar

Nationly makes it easy to ensure eligibility for the Foreign Earned Income Exclusion, automatically generating your Form 2555 with your data to save you time and money during tax season.

Real Reviews from Real Users

Nationly is one of my favorite apps. As an American expat, this app made the process of filing Form 2555 a few taps instead of the painful process it used to be. Essential for expats.”

It makes tracking locations and staying tax and visa compliant effortless for me as an American digital nomad. Saved me a ton of time and money—highly recommend!”

Hidden gem 💎

Nationly was cultch for my taxes this year. Hard tracking your location when nomading but easy peasy with Nationly.”

Essential for Americans abroad

Up to $46,805 in tax savings available for Americans abroad using Nationly

Prove eligibility for the Foreign Earned Income Exclusion under the Physical Presence Test

Demonstrate eligibility for the Foreign Earned Income Exclusion under Bona Fide Residency Test

Easily export Form 2555 with your location data pre-filled for your tax professional or software